nh meals tax change

Nh meals tax change. This budget helps consumers by reducing the meals and rooms tax from 9 to 85 its lowest level in over a decade.

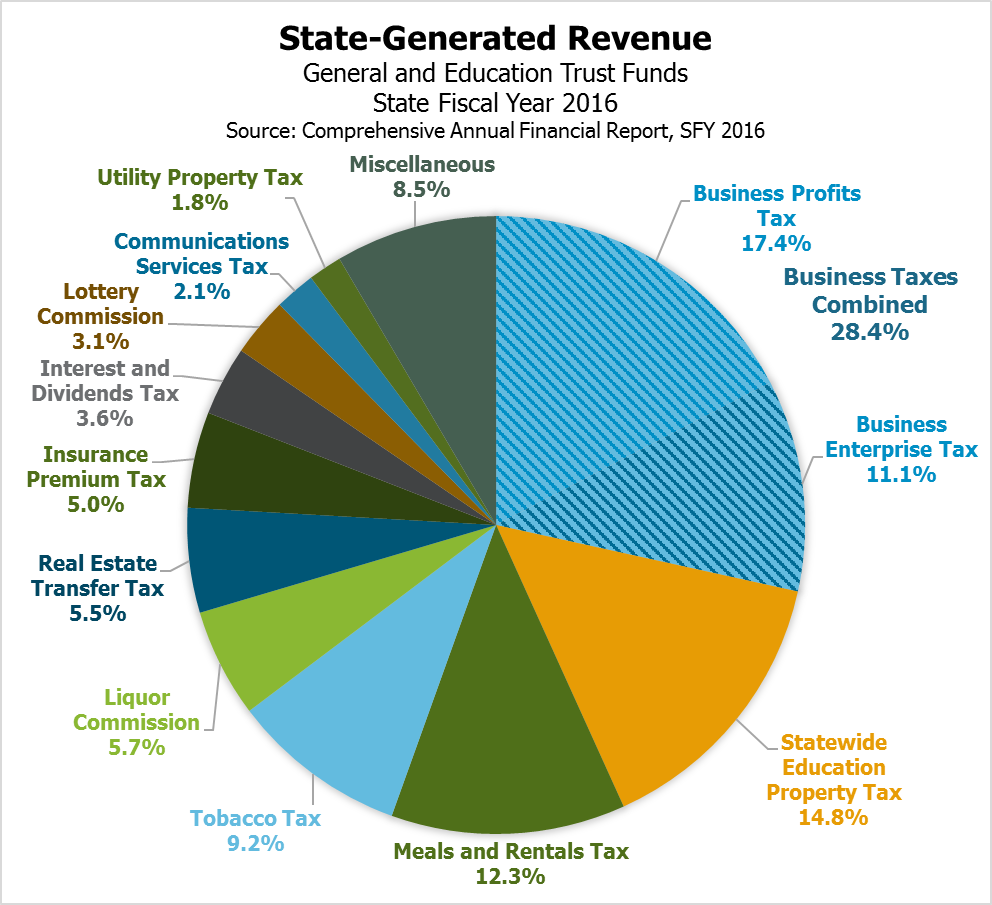

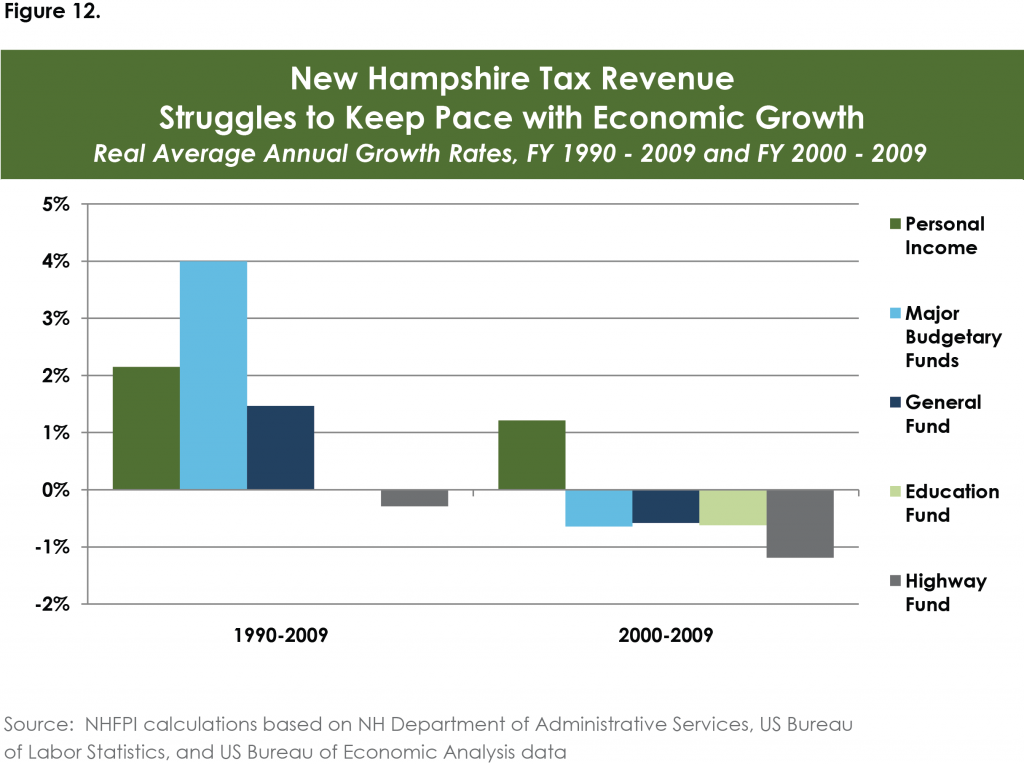

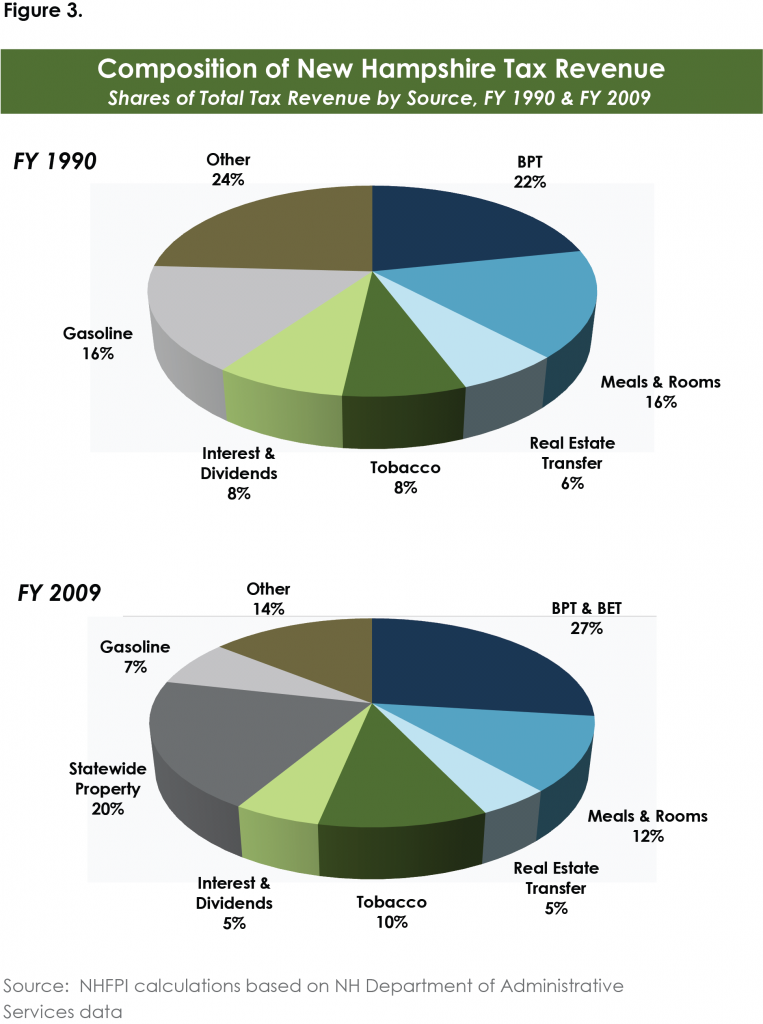

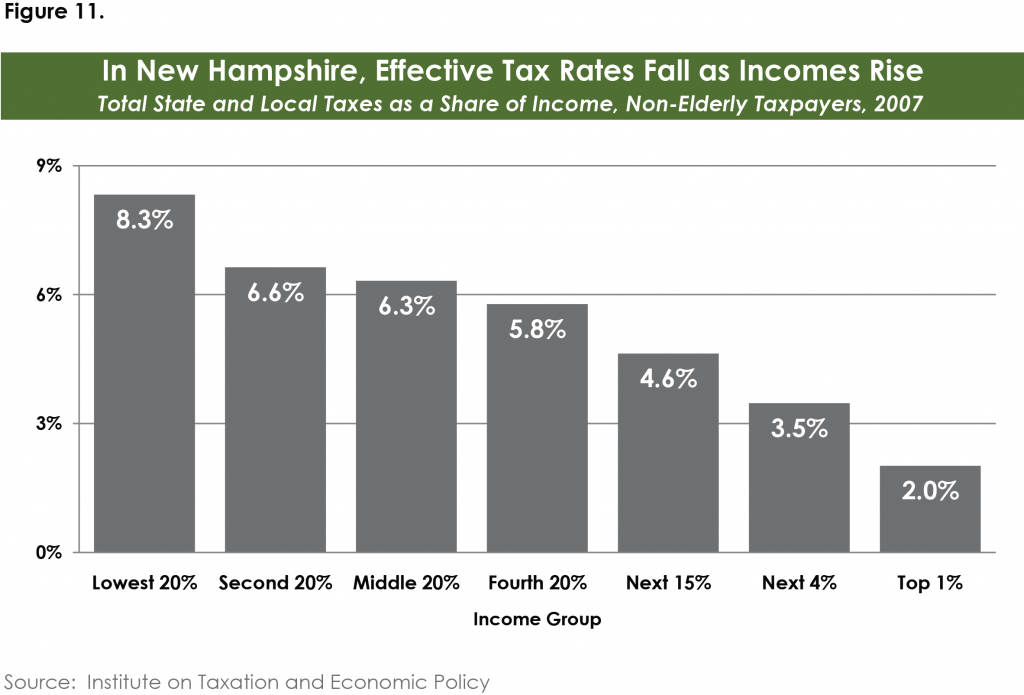

Revenue In Review An Overview Of New Hampshire S Tax System And Major Revenue Sources New Hampshire Fiscal Policy Institute

Years ending on or after December 31 2026 NH ID rate is 2.

. 1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting. The state meals and rooms tax is dropping from 9 to 85. Advertisement Its a change that was proposed by Gov.

By law cities towns and unincorporated places in New Hampshire are supposed to get 40 of the meals and rooms tax revenue but that became less certain after the 2009 recession. New hampshire is one of the few states with no statewide sales tax. Chapter 144 Laws of 2009 increased the rate from 8 to the current rate of 9 and added campsites to the definition of hotel.

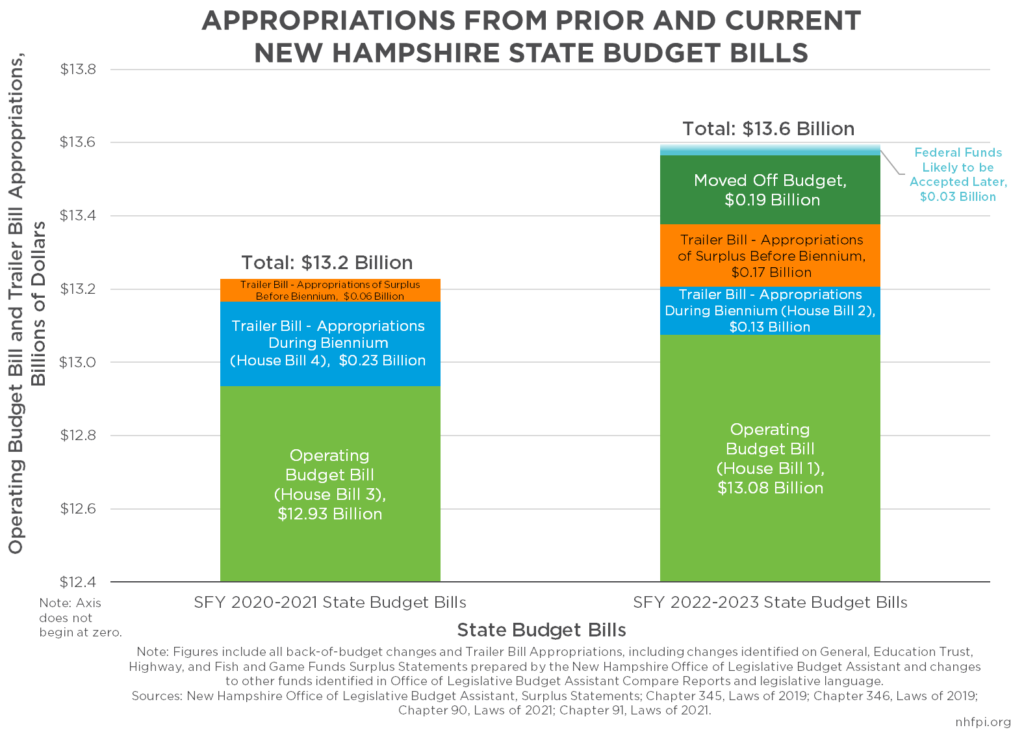

The 2022-2023 budget set revenue. This budget helps consumers by reducing the Meals and Rooms Tax from 9 to 85 its lowest level in over a decade. The tax is assessed upon patrons of hotels and restaurants on certain rentals and upon meals costing 36 or more.

New Hampshire cuts tax on rooms meals to 85. New Hampshire Meals And Rooms Tax Rate Cut Begins Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin Donor Towns Tax Cuts And The Elusive Education Funding Solution New Hampshire Bulletin Business Tax Revenue And The State Budget New Hampshire Fiscal Policy Institute The State Budget For Fiscal Years 2022 And 2023 New. The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5.

New Hampshires meals and rooms tax decreases 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Chris Sununu in this years budget package which passed state government in June. That means someone buying a 24 restaurant meal would pay 12 cents less.

Concord NH Today Governor Chris Sununu issued the following statement as the reduction in the Meals and Rooms Tax from 9 to 85 takes effect today. Changes were made to the meals and rooms tax allocation formula that saw a smaller percentage going to towns and more money staying in the states general fund. Years ending on or after December 31 2025 NH ID rate is 3.

Years ending on or after December 31 2024 NH ID rate is 4. Orders up said Governor Chris Sununu. Speaking of the rooms and meals tax the budget would cut that rate from 9 85 starting in January.

1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting. The current tax on NH Rooms and Meals is currently 9. Years ending on or after December 31 2027 NH ID rate is 0.

Chapter 144 laws of 2009 increased the rate from 8 to the current rate of 9 and added campsites to the definition of hotel. AP Dining and staying overnight in New Hampshire just got a little bit less expensive. To ensure a smooth transition to the new tax rate we are reminding operators and taxpayers alike of this change.

The budget cuts the 5 interest and dividends tax by one percent a year starting in 2023 and eliminating it by 2027 so that really doesnt affect this budget much. Concord NH The New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and Rooms Rentals Tax rate will decrease by 05 from 9 to 85. NH Meals and Rooms Tax.

This budget helps small businesses by reducing the Business Enterprise Tax BET from 06 to 055. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Weve got a five-star delivery for Granite Staters today with the reduction in the meals and rooms tax to its lowest level in over a decade.

Starting Friday the states tax on rooms and meals was reduced from 9 to 85.

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

Historical New Hampshire Tax Policy Information Ballotpedia

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Sununu S Pitch To Suspend Rooms And Meals Tax Worries Nh Town Officials

Thanksgiving Buffet At Woodlake Country Club On November 28th Celebrate Thanksgiving With Family And Frien Champagne Vinaigrette Fruit Display Antipasto Salad

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Meals And Rooms Tax Rate Cut Begins

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute